Alpha is the excess return a fund earns, over its expected return. For example, if a fund is expected to earn 10% rate of return, but it actually yields a 12% rate of return, alpha is 2%. Alpha is also known as the residual return.

One method of calculating the expected returns of a stock is through Capital Asset Pricing Model. This is a model which attempts to estimate the expected rate of return of a stock, using expected rate of return of the market, the beta of the stock and risk free rate of return.

E (Ri) = Rf + β (Rm – Rf)

So Alpha is calculated as:

α = Ri – E [Ri],

Or, α = Ri – [Rf + β (Rm – Rf)]

Here,An AMC is an institution which manages various mutual funds, created by pooling of investments made by investors. Example: Axis Asset Management Company Ltd., HDFC Asset Management Company Ltd., etc.

Arbitrage fund is a type of mutual fund that exploits the difference in the price of a stock between cash and derivatives markets or even different stock exchanges such as BSE and NSE. These funds are hybrid in nature as they have the provision of investing a sizeable portion of the portfolio in debt markets. However, as these funds invest predominantly in equities, their tax treatment is at par with equity funds.

It is the total market value of assets that an investment company/ MF manages on behalf of investors.

Average Maturity is the weighted average maturity of all the debt securities held in the fund. For example, a debt fund having an average maturity of 3 years constitutes debt securities that will on an average mature in 3 years, though individual securities may have maturity different than 3 years.

It is one-hundredth of 1% (0.01%). It is used to measure changes in interest rates. For example, a change in interest rates from 7.00% to 7.50% would be an increase of 50 basis points.

It is a standard index (like Nifty 50, Nifty 500, etc.) against which the selected fund is compared. It is used to provide a point of reference for evaluating a fund’s performance.

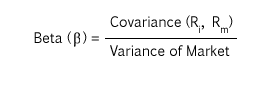

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Funds with beta greater than 1.0 tend to be more volatile than the market, and those with betas below 1.0 tend to be less volatile than the market. For example, a fund with a beta of 1.10 will be 10% more volatile than the market.

It is a debt instrument where the issuer is obliged to pay interest along with principal amount at the time of maturity, to the holder of the bond. It is also commonly known as a fixed income security.

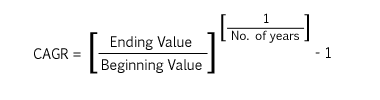

CAGR or Compound Annual Growth Rate is the average annual growth rate of an investment over a specified period of time. It can be calculated as follows:

The profit made on the sale of an investment.

The tax paid on profit from the sale of an individual’s investments.

Closed-ended funds raise a fixed amount of capital through an initial public offering (IPO) and have a fixed maturity period. The funds are then listed and traded like stocks on a stock exchange to provide investors an exit route.

The fixed percentage that is paid out on a regular basis on a fixed-income security.

It is a type of FD where the interest is paid at the time of maturity along with the principal. Interest earned is compounded till the FD matures.

Debt funds are mutual funds that invest in fixed income securities like bonds and treasury bills. These are suitable for investors whose main objective is preservation of capital with moderate growth.

Debt oriented funds invest less than 65% of their portfolio into equity. They are taxed like debt mutual funds.

A generic expression for securities whose prices are based on the prices of another underlying investment. Types of derivatives include futures, options, swaps and warrants.

A direct plan is one, where you invest in mutual funds directly through an AMC where no broker or intermediary is involved.

It means reducing risk by investing in a combination of assets/funds with different risk characteristics. For instance, an individual might invest in a combination of bonds, property and shares.

A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).

A mutual fund dividend is income for investors from dividends and interest earned by a mutual fund's holdings, and it is drawn from the NAV of the fund.

The dividend payout option does not re-invest the profits made by the fund. Profits or dividends are distributed to the investor from time to time, when the fund makes a profit. This decreases the NAV of the fund by an equivalent amount.

Dividends that would otherwise be paid out to investors in the fund are used to purchase more units in the fund.

They are invested in debt securities of different maturity profiles. These funds are actively managed and the portfolio varies dynamically according to the interest rate view of the fund managers.

A company's net profit divided by its number of common outstanding shares. It serves as an indicator of a company's profitability per outstanding share.

ELSS, also known as tax saving mutual funds, are diversified equity funds with a lock in period of 3 years. They offer tax benefits u/s 80C up to Rs. 1,50,000.

Equity funds are mutual funds that invest principally in stocks.

When a larger proportion (>=80%) of the portfolio is invested in stocks of companies with large market capitalization.

Diversified mutual funds which invest in stocks across large,mid and small market capitalization.

When 65% or more of the portfolio is invested in stocks of mid and small size companies. They are usually more volatile than large cap funds.

When 65% or more of the portfolio is invested in stocks of small size companies. Amongst all equity funds, they are the most volatile but have also provided the highest return over long holding periods.

Equity oriented funds allocate at least 65% of their funds into equity and the rest to debt. They are taxed just like equity mutual funds.

Exchange Traded Funds are essentially Index Funds that are listed and traded on exchanges. An ETF is a basket of stocks or any other asset class that reflects the composition of an index.

Gold ETFs: Gold ETFs are exchange traded funds where the underlying asset is gold. Therefore, value of gold ETF depends upon the price of gold.

Equity ETFs: Equity ETFs are passive investment instruments that are based on equity market indices (like Nifty 50, Nifty 500, etc.) and invest in securities in same proportion as the underlying index. Because of its index mirroring property, their returns usually revolve around their benchmark indices.

Debt ETFs: Debt ETFs are passive investment instruments that invest in various debt instruments like treasury bills, government securities, call money, etc.

The expense ratio of a mutual fund is the total percentage of fund assets used for administrative, management, advertising, and all other expenses. An expense ratio of 1% per annum means that each year 1% of the fund's total assets will be used to cover expenses.

Exit load or exit charges are fees collected from investors for exiting a scheme prematurely. Its main objective is to prevent the investor from exiting early. It is usually nil for mutual funds sold after one year of purchase. However, it varies from fund to fund.

A fixed deposit (FD) is a financial instrument provided by banks and companies which usually provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

Company fixed deposits usually offer higher rate of interest than banks but are unsecured. They are independently rated by credit rating agencies like CARE, ICRA, etc. which assess their credit risk. Company deposits are governed by the Companies Act under Section 58A.

These are closed ended debt funds with a fixed maturity date which invest in debt & money market instruments maturing on or before the date of the maturity of the scheme. These can be purchased only during its New Fund Offer (NFO).

Fund of Funds is a mutual fund scheme that invests in various funds rather than investing directly in stocks, bonds or money market instruments. It provides greater diversification than traditional Mutual Funds by spreading investors’ money across different investing styles.

Mutual fund schemes floated by asset management companies with exclusive investments in government securities.

These are mutual funds which invest in various forms of gold. It can be in the form of Gold ETFs or stocks of gold mining companies.

In the growth option of a mutual fund scheme, all profits made by the fund are reinvested into the scheme and no dividends are declared. Hence, the NAV increases over time and investor gets higher capital gains. No dividends are declared.

Hybrid funds are a category of mutual funds that are characterized by a portfolio that is made up of a mix of stocks and bonds, which can vary over time. These funds provide more stable returns than equity funds but are more volatile than debt funds.

It refers to a sustained increase in the general price level of goods and services in an economy over a period of time.

For example, if the same basket of goods cost you Rs. 100 last year, and Rs. 105 today, the extra Rs. 5 is due to an inflation of 5%. Your money supply hasn't changed, but the price of your goods has. This is the effect of inflation.

Indexation is a process of adjusting the purchase price for inflation mainly for calculating long term capital gains tax. This is done so that the investor is taxed only on the capital gain over and above the price rise caused by inflation.

Indexed Purchase Price = Purchase Price * (CII for current year / CII for year of purchase)

Now,

Tax liability = Tax Rate* (Sale price – Indexed Purchase Price)

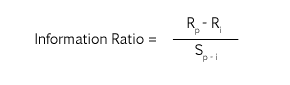

The information ratio tells an investor how much excess return is generated from the amount of excess risk taken relative to the benchmark. It is calculated by dividing the portfolio’s excess return relative to its benchmark by the variability of that excess return (tracking error).

Funds which invest in stocks of companies located outside India. Schemes with a mandate to invest the majority of their assets in overseas markets/ global commodities will form part of this category.

They are a type of mutual fund whose units can be bought or sold only during specific time periods, which are pre-determined by the fund house. They resemble closed ended funds in a way, as they do not permit regular buying and selling and remain closed for the time interval specified by the fund. On the other hand, they resemble open end funds as well because they open for subscription frequently and do not remain closed for long periods. Thus, they combine the features of both open ended and closed ended funds.

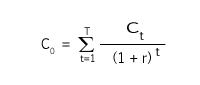

The internal rate of return for an investment project is the effective rate of interest that equates the present value of income and outgo, i.e. it makes the net present value of the cash flows equal to zero. A higher IRR indicates a more profitable project.

Nothing to display

Nothing to display

These invest in very short term debt securities. Instruments in liquid funds have a maturity period of maximum 91 days.

The minimum duration till which the funds invested cannot be redeemed/ withdrawn.

These funds invest in long term bonds or government securities with an average maturity greater than 7 years. They are highly vulnerable to the changes in interest rates and are suitable for investors who have a long term investment horizon and higher risk taking ability.

It implies investing the whole sum in one go, rather than spreading it over monthly payments.

Market capitalization (market cap) is the total market value of the shares outstanding of a publicly traded company; it is equal to share price x number of shares outstanding.

Mean is the average of the numbers.

These funds invest in medium term bonds or government securities with an average maturity of 3 to 7 years. These funds tend to work well when entry and exit are timed properly as they are sensitive to changes in interest rates.

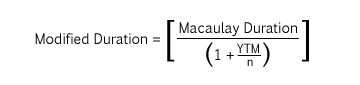

Modified duration is the approximate percentage change in a bond's price for a 1% change in yield (which is usually dependent on market interest rate), assuming that the bond's expected cash flow does not change when the yield changes.

It is a professionally managed financial instrument that pools money from many investors to purchase securities such as stocks, bonds, money market instruments, etc.

This is the price at which investors buy and sell mutual fund units. It is calculated as the value of a fund's asset less the value of its liabilities per unit.

It is a type of FD where the interest is paid out periodically (monthly, quarterly, etc.) to the investor. This interest is taxable. This scheme is most suitable for an individual who is in need of an interest payout periodically.

An open-ended fund or scheme is one that is available for subscription and repurchase on a continuous basis. These schemes do not have a fixed maturity period.

The term portfolio refers to any collection of financial assets.

P/B Ratio or Price-To-Book ratio is used to compare a stock’s market value to its book value.

P/E or Price Earnings Ratio is the ratio of a company’s market price to its earnings per share.

Nothing to display

A regular plan is one, which you invest in through a mutual fund distributor and for which the distributor earns a commission.

The profit/ loss generated from an investment, expressed as a percentage of total amount invested.

It is the chance that an investment's actual return will be different than its expected return. Risk includes the possibility of losing some or all of the original investment. It is of two types:

Systematic risk: It refers to the inherent risk affecting the whole stock market and therefore it cannot be reduced or diversified.

Unsystematic risk: Unsystematic risk is the extent of variability in the stock or security’s return on account of factors which are unique to a company or industry. Unsystematic risk can be reduced through diversification.

Funds which invest predominantly (>=65%) in businesses that operate in a particular industry or sector of the economy.

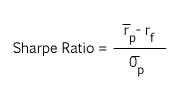

The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility.

These funds invest in short term bonds or government securities whose average maturity is on an average between 1 to 3 years. As these funds have a higher maturity profile, they are more sensitive to changes in interest rates than Liquid and Ultra Short Term Funds.

SIP is a method of investing in mutual funds by paying a fixed sum, at predetermined intervals (monthly, quarterly, etc.), into the fund.

SIP calculator is a tool that calculates the expected accumulated value of your SIP investments.

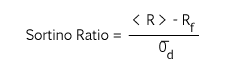

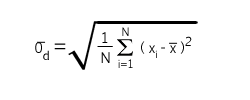

The Sortino Ratio is a modification of Sharpe Ratio. It uses downside risk (downside deviation) in the denominator instead of the portfolio standard deviation. Since upside variability is not necessarily a bad thing, Sortino ratio is sometimes more preferable than Sharpe ratio.

A measure expressing the variation of the returns of a fund from the mean returns of the fund.

The difference between the returns of a mutual fund and its benchmark is known as a fund's tracking error.

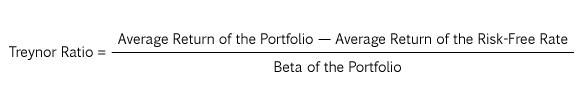

Treynor ratio is a measure of excess returns earned over returns of a risk-free investment per unit of market risk.

The turnover ratio is the percentage of a portfolio that has been "turned over" or replaced with other holdings in a given year. Higher turnover implies higher portfolio churning, leading to higher transaction fees, impacting fund’s returns.

These funds invest in very short term debt securities and their average maturity is 91 days to 1 year.

It is a rate at which the price of a security increases or decreases for a given set of returns. Standard deviation is the most widely used measure of volatility.

Nothing to display

XIRR or Extended Internal Rate of Return is a way of calculating the annualized return for a series of cash flows occurring at various intervals throughout the investment period. IRR is used when the time period between cash flows are equivalent while XIRR accounts for uneven cash flow intervals as well.

It refers to the period beginning from 1st January of the current year till the current date/ today.

Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until the end of its lifetime. In other words, it is the internal rate of return of an investment in a bond if the investor holds the bond until maturity and if all payments are made as scheduled.

A fixed income investment that is issued at a discount to its face value and pays no coupons (interest) through its life. For example, an investor could pay Rs.800, receive no annual payments for five years, but get Rs.1000 when the bond matures.